Get the free usda loan application form

Show details

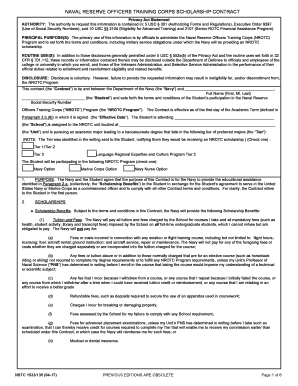

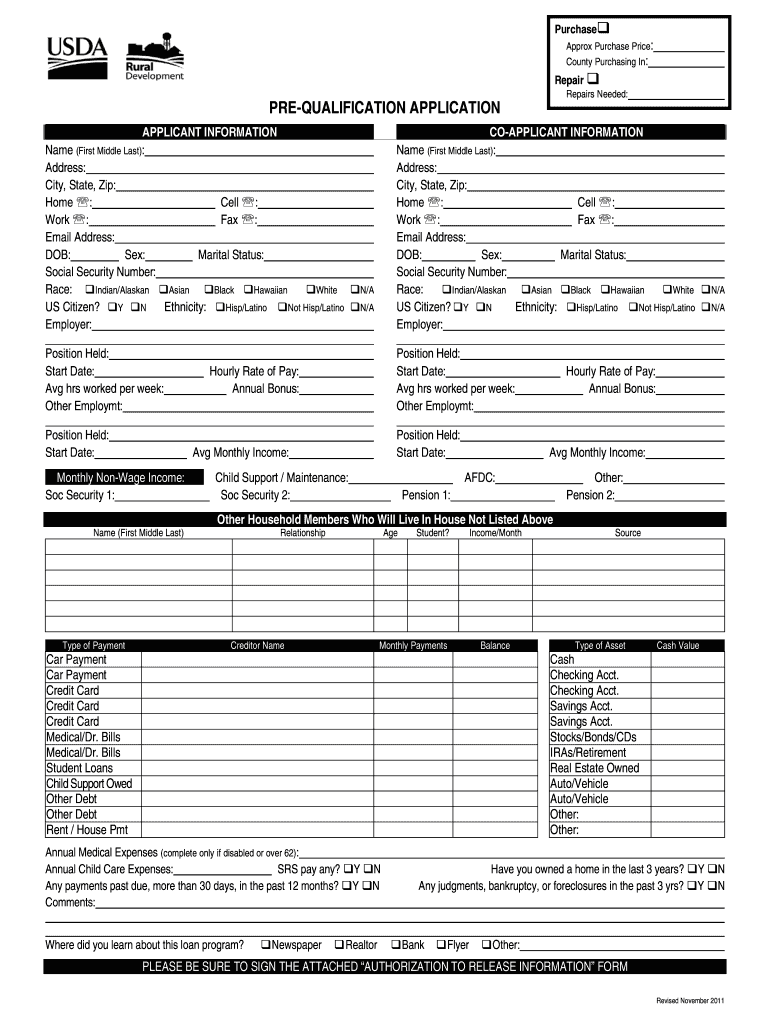

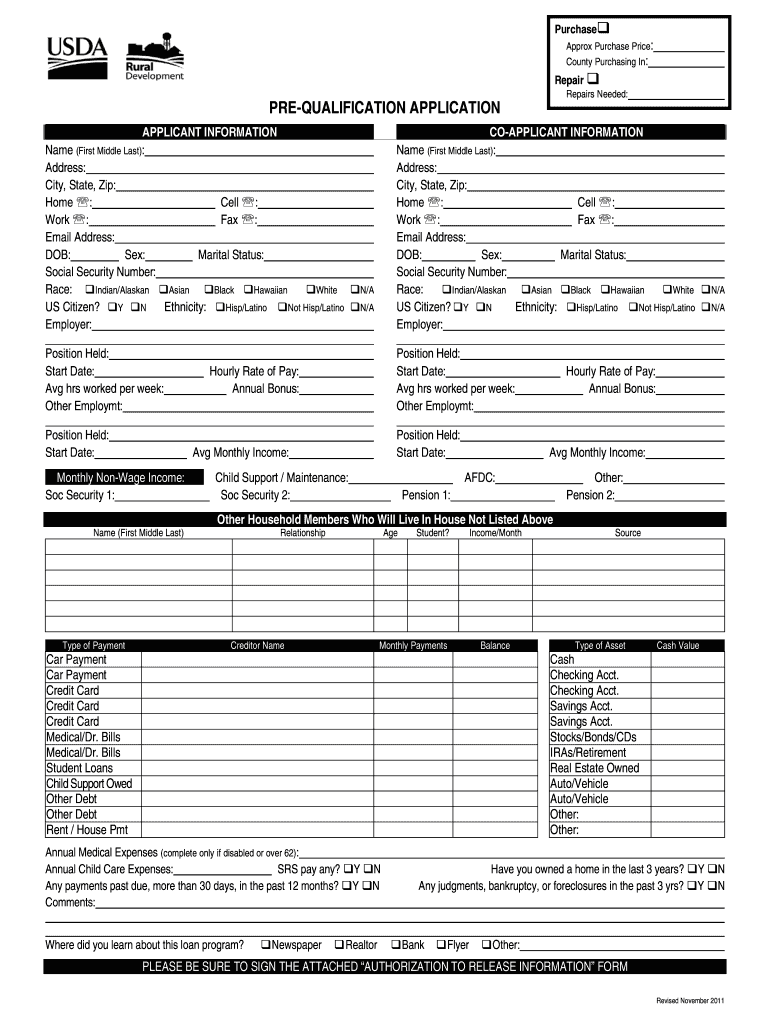

Purchase Approx Purchase Price: County Purchasing In: Repair PRE-QUALIFICATION APPLICATION APPLICANT INFORMATION Name (First Middle Last): Address: City, State, Zip: Home : Cell : Work : Fax : Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usda section 502 loan form

Edit your usda paperwork form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usda direct loan application online pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

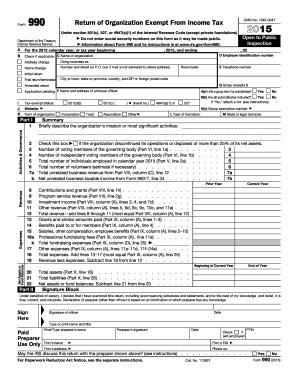

How to edit usda loan 502 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit usda section 502 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

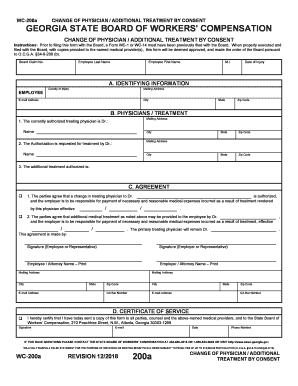

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

usda section 502 guaranteed loan form

: Try Risk Free

People Also Ask about

What are USDA qualifying ratios?

USDA Loan Eligibility A minimum credit score of around 620 (credit score requirements might vary per borrower) A debt-to-income (DTI) ratio of 41% or less. Have an income no higher than 115% of the median household income in your area.

How many days before closing does lender pull credit?

Lenders will typically pull your credit within seven days before closing. However, most lenders will only check with a “soft credit inquiry,” so your credit score won't be affected.

Does USDA pull credit before closing?

USDA allows lenders to underwrite and approve USDA home loans manually at the lender's discretion. Once cleared by your lender, the USDA must review your loan for final loan approval before you can close.

What does USDA do for final approval?

USDA completes a final “sign-off” (a few days to a few weeks) The lender completes underwriting and final approval. Lender sends closing documents to the escrow company, which you sign (1 week) After signing on closing day, the house is yours.

Does your credit get pulled right before closing?

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

How long does it take USDA to approve a loan?

Once you've signed a purchase agreement, the USDA loan application process typically takes around 30-45 days. The faster all parties work together to complete and provide documents for loan approval, the quicker final loan approval and closing can happen.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get usda loan application form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific usda loan application form and other forms. Find the template you need and change it using powerful tools.

How do I edit usda loan application form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your usda loan application form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete usda loan application form on an Android device?

Complete usda loan application form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

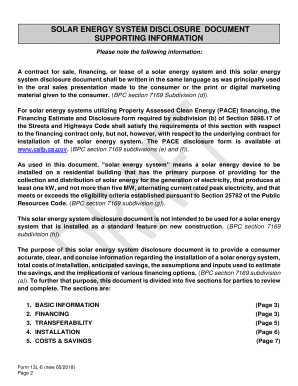

What is sfh section 502 glp?

SFH Section 502 GLP refers to the Rural Development's Single Family Housing Section 502 Guaranteed Loan Program, which provides financial assistance to low- and moderate-income households to buy homes in rural areas.

Who is required to file sfh section 502 glp?

Lenders participating in the USDA’s Section 502 Guaranteed Loan Program are required to file SFH Section 502 GLP to report loan applications and details about eligible borrowers.

How to fill out sfh section 502 glp?

To fill out SFH Section 502 GLP, lenders need to complete the required application forms and provide necessary documentation about the borrower’s income, credit history, and the property being purchased.

What is the purpose of sfh section 502 glp?

The purpose of SFH Section 502 GLP is to promote homeownership among low and moderate income individuals and families in rural communities by providing guarantees to lenders that reduce their risk.

What information must be reported on sfh section 502 glp?

Information that must be reported on SFH Section 502 GLP includes the borrower's financial data, loan amounts, terms, property details, and compliance with eligibility requirements for the program.

Fill out your usda loan application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usda Loan Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.