Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

USDA stands for the United States Department of Agriculture. It is a federal agency responsible for overseeing laws and regulations related to agriculture, food safety, and rural development in the United States. The USDA's primary goal is to ensure the safety of the nation's food supply and promote agricultural sustainability.

To "pre" could refer to the term "preparation." In the context of USDA, preparing can involve several actions depending on the specific need or purpose. Here are some general steps for preparing with respect to USDA guidelines:

1. Familiarize yourself: Understand the specific requirements and regulations relevant to your area of interest within the USDA's jurisdiction. This could include food safety practices, farming standards, or rural development programs.

2. Research and gather information: Explore available resources provided by the USDA, such as their official website, publications, or local field offices. These sources can help you gather the necessary knowledge and guidance for your particular needs.

3. Follow guidelines: Ensure compliance with USDA regulations and guidelines. This may involve maintaining proper food safety practices, adhering to agricultural standards, or fulfilling criteria for rural development programs.

4. Engage with USDA programs: If you are a farmer or involved in agriculture, explore and engage in relevant USDA programs that aim to support and promote agriculture, rural development, or food assistance initiatives. This could involve applications, registrations, or seeking assistance from local USDA offices.

It is important to note that the specific requirements for preparation can vary depending on the context and purpose within the USDA's scope. Therefore, it is recommended to always refer to official USDA resources or seek guidance from local USDA offices for comprehensive and accurate information.

Who is required to file usda how to pre?

The United States Department of Agriculture (USDA) provides various programs and services, and individuals or organizations may be required to file certain USDA forms or paperwork based on their specific circumstances. Here are a few examples:

1. Farmers and ranchers: Farmers and ranchers may need to file USDA forms for programs such as crop insurance, farm loans, conservation programs, or agricultural marketing programs.

2. Food establishments: Food establishments, such as restaurants or food processors, may need to file certain USDA forms for inspections, food safety programs, or compliance with regulations.

3. Individuals or organizations participating in USDA programs: Individuals or organizations participating in USDA programs, such as the Supplemental Nutrition Assistance Program (SNAP) or the Women, Infants, and Children (WIC) program, may be required to submit specific USDA forms for enrollment, reporting, or compliance purposes.

The specific forms, requirements, and filing procedures can vary based on the specific USDA program or service. To determine the required forms and filing instructions, individuals or organizations should visit the USDA's official website or contact the appropriate USDA department or agency directly.

How to fill out usda how to pre?

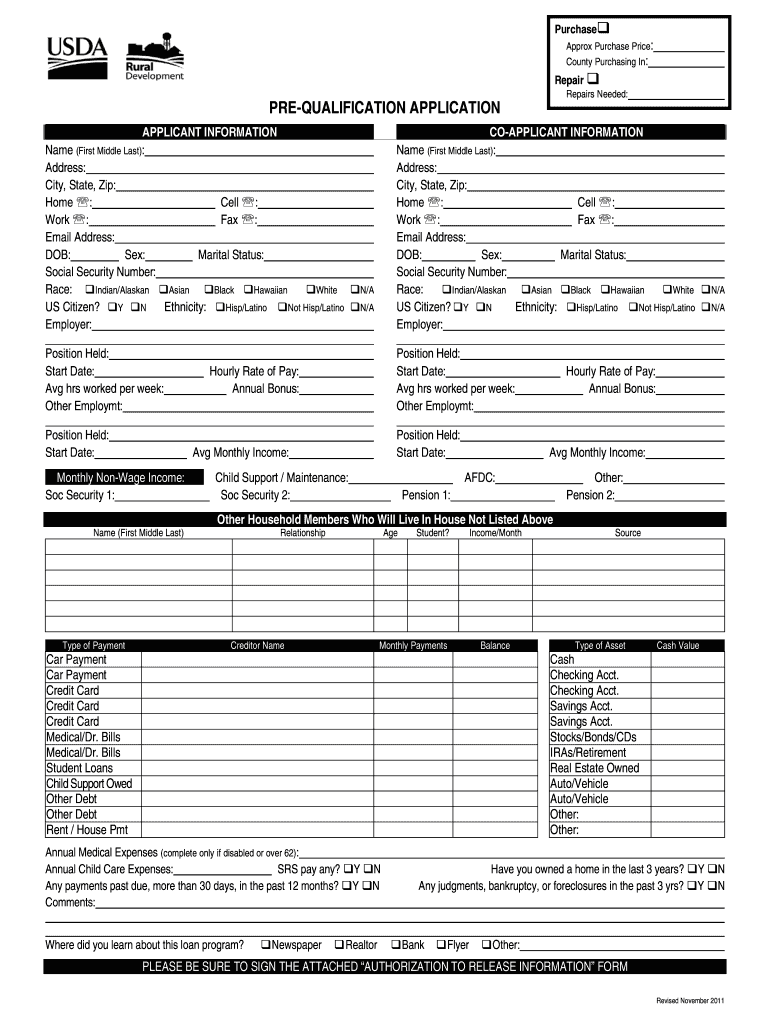

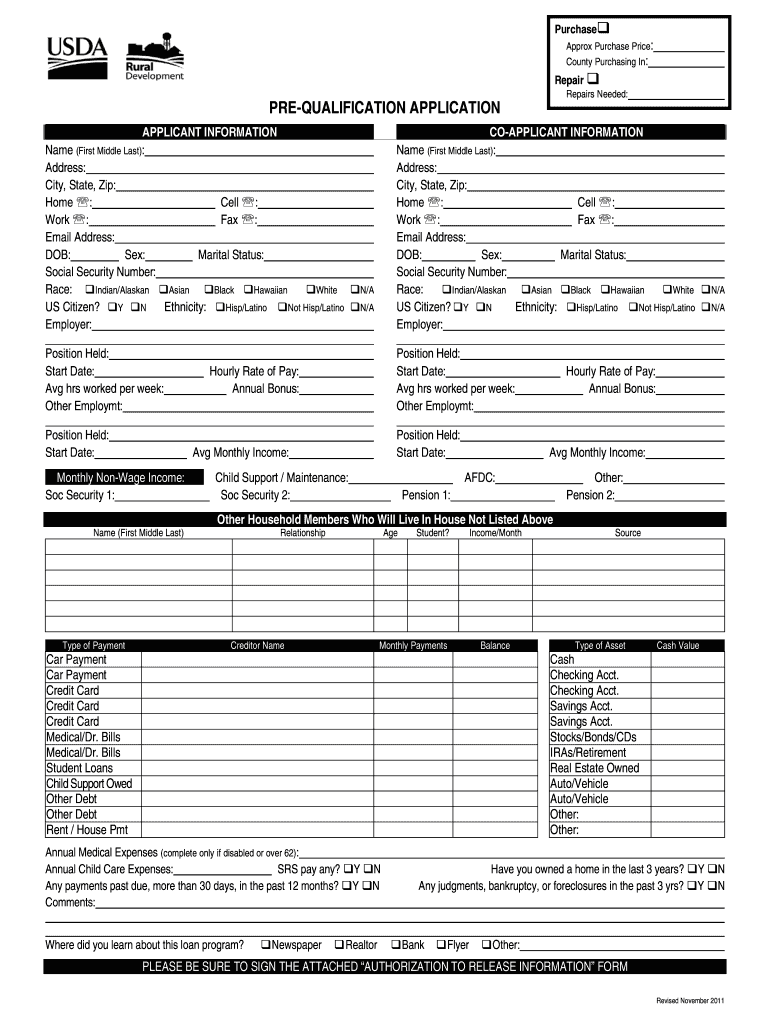

To fill out the USDA Home Loan Prequalification Form, also known as Form RD 3555-1, follow the steps below:

1. Begin by downloading the form from the official USDA website, or obtain a hardcopy from a local USDA office.

2. Section 1: Borrower Information

Provide your personal details, such as full legal name, mailing address, social security number, and any co-borrower information if applicable.

3. Section 2: Joint Credit

Select the appropriate option to indicate whether you are applying for joint credit or individual credit.

4. Section 3: Monthly Income

Provide accurate information about your monthly income, such as wages, self-employed income, rental income, etc. If you have a spouse or co-borrower, include their income details as well.

5. Section 4: Adjustable Payment (AP)

Indicate whether you anticipate any adjustments in your ability to make the monthly payments over the next three years.

6. Section 5: Debts and Obligations

List all your recurring monthly debts and obligations, such as credit card payments, car loans, student loans, child support, etc. Include the minimum monthly payment and the outstanding balance for each.

7. Section 6: Assets and Liabilities

Provide details of any assets you own, such as savings accounts, stocks, retirement accounts, and the corresponding values. List your liabilities, including outstanding loans and credit card balances.

8. Section 7: Property Information and Purpose of Loan

Specify the purpose of the loan (purchase, construction, or refinancing), and provide details about the property, such as its address, type, and estimated value.

9. Section 8: Ethnicity, Race, and Sex

Indicate your ethnicity, race, and sex as the information is required for monitoring fair lending practices.

10. Sign and Date

Finally, sign and date the form. If you have a co-borrower, they should also sign and date accordingly.

11. Submission

Submit the completed form to your USDA-approved lender. They will review the information provided and determine your prequalification status.

Remember, filling out the form accurately and honestly is essential for a proper evaluation of your prequalification. If you have any doubts or questions, it is recommended to consult with a USDA-approved lender or a housing counselor for guidance.

What is the purpose of usda how to pre?

The purpose of USDA (United States Department of Agriculture) is to develop and execute policies and programs related to agriculture, rural development, food safety, nutrition, and natural resources conservation in the United States. Its main goals include promoting agricultural production sustainability, ensuring food safety and quality, supporting rural communities and economies, and conserving natural resources.

As for "how to pre," it is unclear what you are referring to. Could you please provide more context or clarify your question?

What information must be reported on usda how to pre?

"To report successfully on USDA How to Pre, the following information must be included:

1. Product Information: Provide details about the food product being reported, such as the name, brand, and any specific identifiers like lot numbers or codes.

2. Contamination Details: Describe the nature of the problem or concern, specifying the issue related to the product (e.g., foreign objects, spoilage, quality, allergic reactions, etc.).

3. Supplier Information: Include the name and contact details of the manufacturer, distributor, or retailer from whom the product was obtained. If possible, provide information about where and when the product was purchased.

4. Date and Time: Indicate when the incident or problem occurred, including the date and approximate time.

5. Packaging: If applicable, supply information related to the packaging, such as the type of container, size, and packaging materials.

6. Description: Provide a detailed description of the issue or problem encountered. Include any physical characteristics, odors, tastes, or reactions experienced.

7. Photos or Samples: If possible, take and attach photographs of the product and any issues or contaminants observed. Alternatively, save a sample of the product for later analysis if necessary.

8. Health Impact: Explain the health impacts experienced, if any, by individuals who consumed or came into contact with the product. This includes symptoms, severity, and any necessary medical treatment sought.

9. Personal Information: Enter your personal contact information, including name, address, phone number, and email address.

10. Submitting the Report: Follow the USDA How to Pre reporting guidelines to submit the report via their online form or contact the relevant USDA Food Safety and Inspection Service (FSIS) office by phone."

Note: The specific reporting process and requirements may vary depending on the specific USDA program or portal used. Please refer to the official USDA How to Pre resources and guidelines for the most accurate and up-to-date reporting information.

When is the deadline to file usda how to pre in 2023?

I apologize, but I couldn't find any specific information regarding a USDA filing deadline related to "how to pre" in 2023. It's possible that the term or query you provided could be incomplete or unclear. Could you please provide more details or clarify your question?

How can I get usda how to pre qualify form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific usda prequalification application form and other forms. Find the template you need and change it using powerful tools.

How do I edit sfh section 502 glp form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your usda home loan prequalification worksheet to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete usda pre qualification application on an Android device?

Complete usda pre qualification worksheet form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.